Strategic Pivot: A Closer Look at a High-Value Mall Portfolio

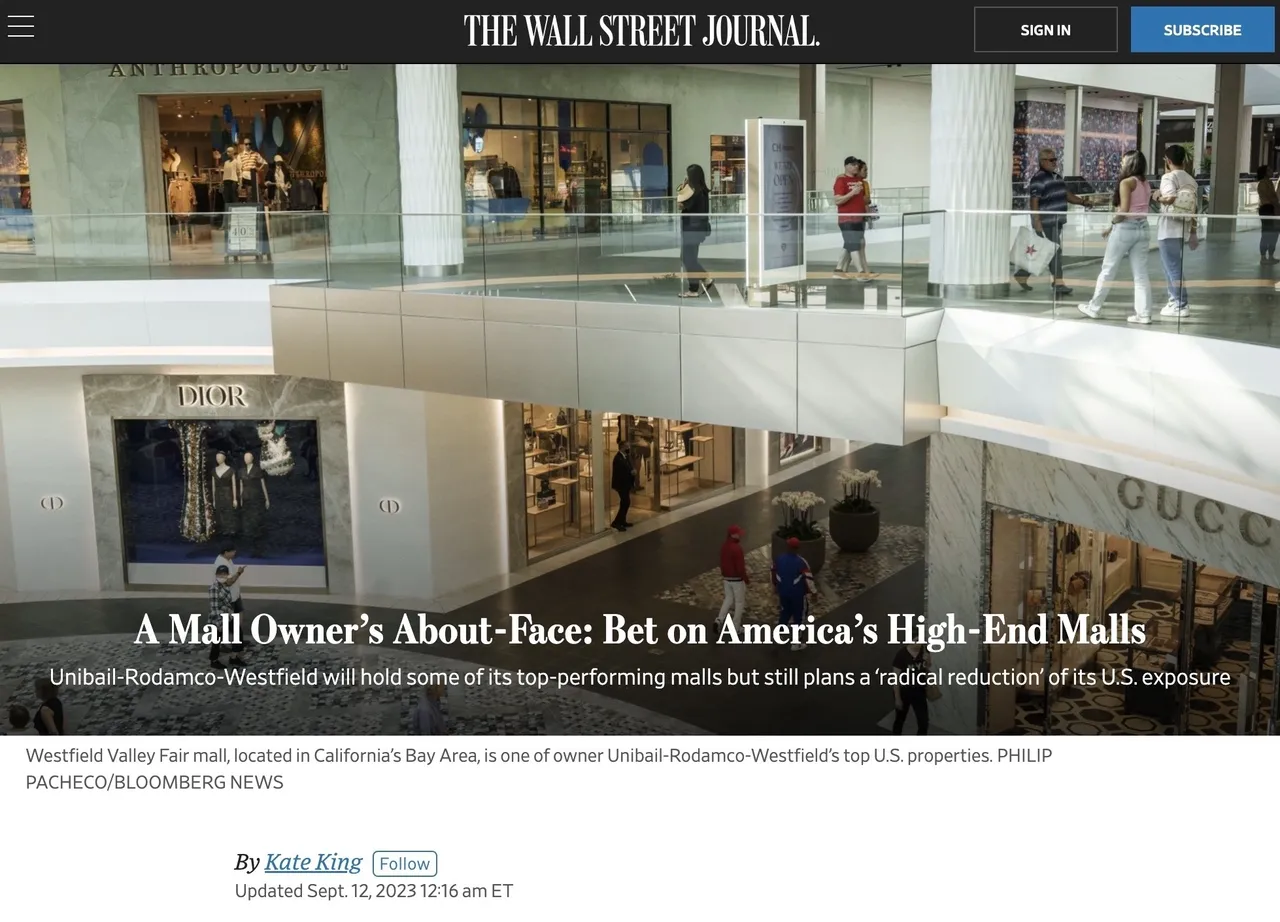

Revised Exit Strategy Unibail-Rodamco-Westfield, has adjusted its initial plan to exit the U.S. market. This change reflects a vote of confidence in the high-end mall business, as the company intends to retain some of its top-performing malls.

Strong Performance of High-End Malls Well-located, high-end malls in the U.S. have shown resilience and growth. Unibail's flagship properties have seen a return to 2019 occupancy levels, increased customer foot traffic, and higher tenant sales in the first half of the year.

Value-Based Portfolio Management Unibail's decision to hold onto its most valuable properties and invest in them is driven not only by strong performance but also by the substantial value these assets hold.

Overall, Unibail's actions suggest a nuanced approach to commercial property and retail management, emphasizing the value of high-end malls and their potential for growth in the post-pandemic landscape.